Transform Digital Lending Operations

End-to-End Lending Lifecycle Platform for

Banks | NBFC | FinTech | Others

Simplify loan origination, loan management, and collections through

a unified digital platform with seamless integrations.

Reduce loan processing time significantly while strengthening credit

risk controls.

Unified Digital Lending Ecosystem

DigiOps brings loan origination and loan management together on a single platform with automated decisioning and real-time compliance controls.

Loan Origination System

Automated document checks and configurable risk scoring reduce approval time.

- ✓ Automated credit scoring & risk analysis

- ✓ Real-time compliance & regulatory checks

- ✓ Multi-channel customer onboarding

Loan Management System

Track portfolios, disbursements, and collections with configurable workflows.

- ✓ Automated disbursement & EMI scheduling

- ✓ Real-time portfolio monitoring & alerts

- ✓ Integrated accounting & reporting

DDMS

Structured tracking and multi-level approvals for policy deviations and deferrals in loan/compliance processes—with audit trails, validity periods, and expiry alerts.

- ✓ Create, review, approve/reject, and close requests with full audit logs

- ✓ Deferrals with due dates, extensions, and automatic expiry alerts for timely review

- ✓ Integrates with LOS/LMS via webhooks for eligibility checks and real-time status updates

Unified Architecture

Cloud-native platform with API-first design, microservices architecture, and real-time data synchronization across all modules.

Built for Modern Lending

Every capability designed to accelerate loan operations while maintaining control, accuracy, and compliance.

Credit Risk Scoring

Configurable scoring models using multiple data parameters for consistent and reliable credit decisions.

Real-Time Processing

Process loan applications instantly with automated validations, approvals, and notifications.

Compliance Management

Built-in regulatory checks with real-time monitoring and complete audit trails.

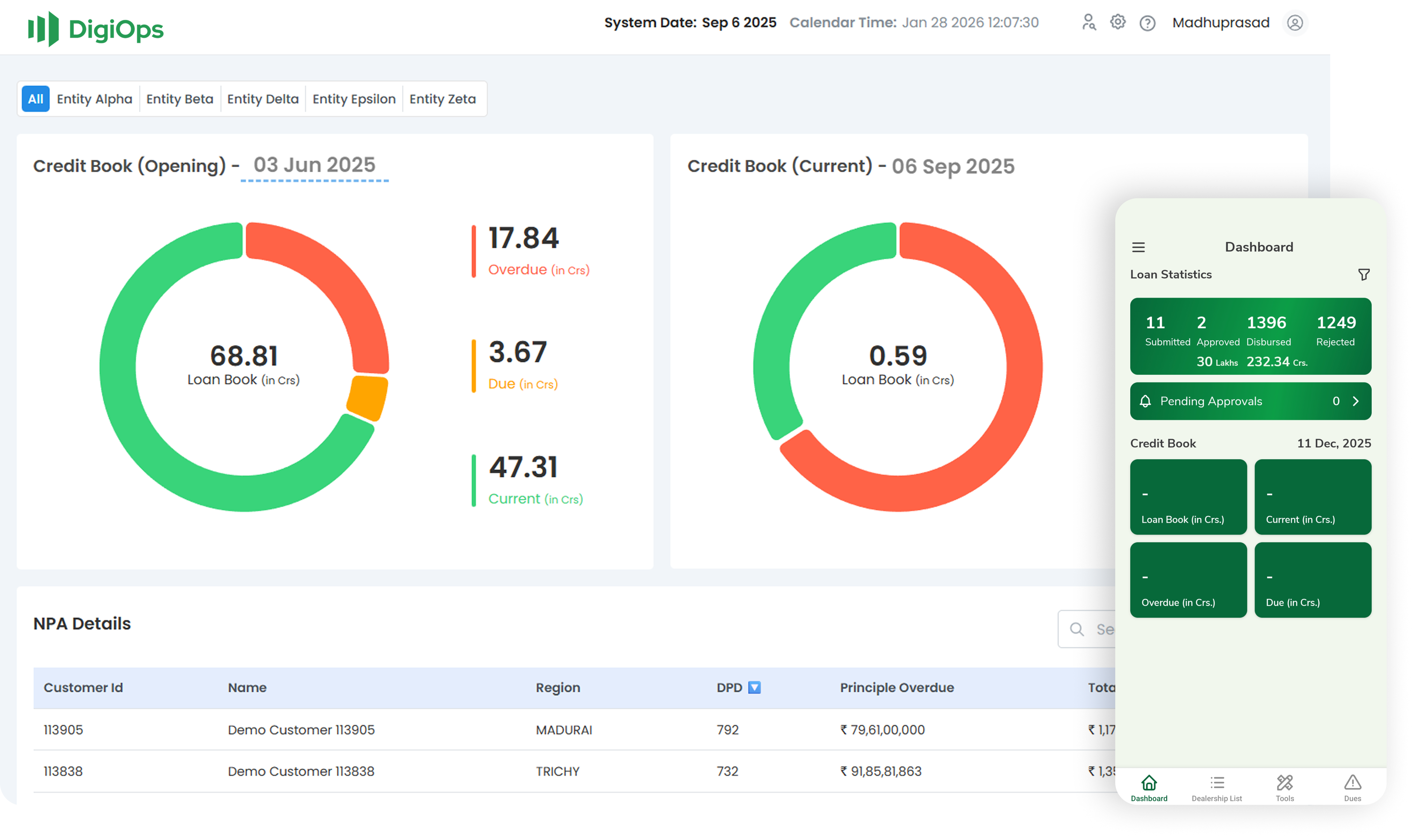

Operational Analytics

Live portfolio insights with dashboards and customizable reports.

Omnichannel Access

Seamless experience across web, mobile, and API channels with unified data.

Workflow Automation

Configurable workflows with automated routing, approvals, and exception handling.

Lending Across Sectors

Trusted by banks, NBFCs, and fintechs across diverse industries for digital lending excellence.

Build Faster, Smarter Lending Operations

A unified platform for origination, servicing, and collections.

Let’s Talk About Your Lending Needs

Our lending specialists will help you design the right digital lending solution for your business.